Walmart Smashes Q2 2024 Earnings: Gaining Share in Grocery, Huge Tailwinds Across the Business

"Here, hold my beer - wait, do you even ship beer?"

Walmart CEO Doug McMillon to Target CEO Brian Cornell.

It’s hard to overstate how much Walmart crushed this quarter. Here are a few data points, including raised guidance. Simply, they are doing what they said, and the business is better than their previous expectations, and the upside is great. This reminds me of listening to a Target earnings call 4 years ago.

What Were Walmart's Q2 2024 Earnings?

Consolidated revenue of $161.6 billion, up 5.7%

Consolidated operating income up $0.5 billion, or 6.7%, adjusted operating income up 8.1%

Global advertising business grew approximately 35%; # advertisers grew 60% y/y

Pulling forward ROI improvements from FY 2025 into FY 2024.

What Are the Key Highlights Across Walmart's US Business?

Walmart U.S. comp sales up 6.4%

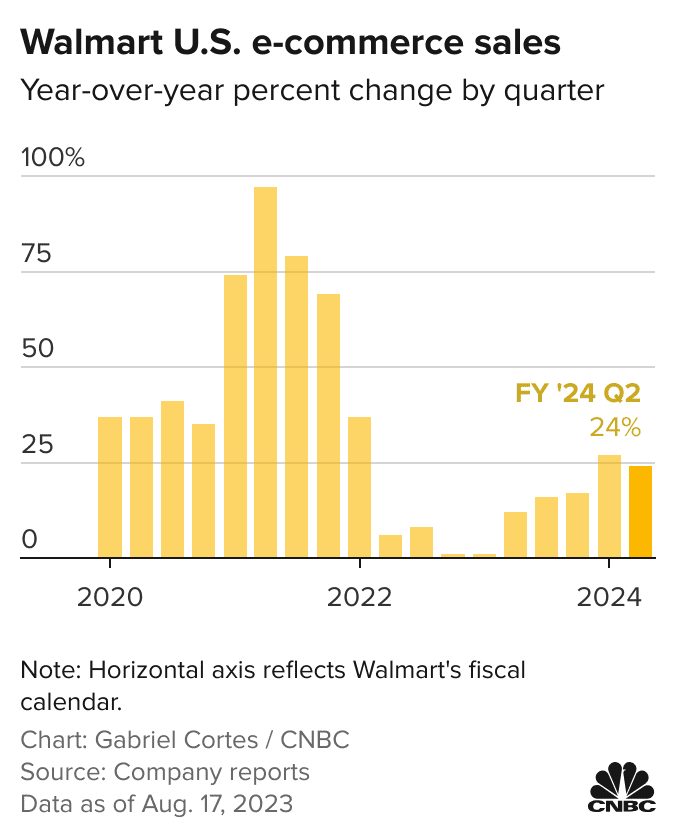

eCommerce up 24%, led by pickup & delivery

Operating margin 5.5%, up from 5.4% LY

Shipping more than 50% of digital orders from Stores (Target is at at 90%+ = WMT Tailwind)

Walmart Connect advertising sales grew 36%. Doubled the business in 2 years.

Marketplace seller items up 4x from a year ago. # Marketplace customers increased 14% in Q2. Fulfillment Services adoption up 50%.

Weekly active digital users increased 20%

Categories:

General merchandise declined mid-single digits

Grocery inflation moderated 700bps y/y and 400bps q/q, still 20% up on 2-year stack

INTL:

Ad business up 40%

80% of digital orders are delivered in under 1 hour in China.

What Operational Changes and Efficiencies Contributed to Walmart's Strong Performance?

US inventory declined 8% with higher in-stock levels

15% of stores served by an automated regional facility. These are 30% greater units/hr efficiency. Huge upside here.

General merchandising buying discipline improved

How Did Sam's Club Fare in Q2 2024 in Terms of Sales Growth and Operating Margin?

Comp sales growth 5.5% (down from 9.5% y/y last year)

Operating margin at 2.3% (up rom 1.8% last year)

What Is the Current State of the Grocery Market, and How Is Walmart Competing?

Gaining share. (Amazon should be worried about facing a strengthened Walmart)

Private brand sales up 9%

What Are the Notable Trends in Consumer Behavior and Spending, and How Is Walmart Responding?

Trading down to private labels.

Spend shifting to grocery and health/wellness.

Consumers not compromising on holiday seasons. Back to Schools started strong, which is a holiday predictor.

# Category share gains increasing, and all demos. Consistent for 5-6 quarters.

Discretionary and household budgets pressured. Drawdown in savings.

Canadian customers feeling pinch in interest rates faster than US (lower mortgage durations than US)

What Are the Expectations and Guidance for Investors Regarding Walmart's Performance in FY 2024?

Increasing full-year guidance and sales expectations. Still cautious.

Net sales growth 4-4.5%; operating income grow 7-7.5%

Inflation slightly lower than last year, but stubborn.

Food % to total will increase.

In-short:

Amazon should be terrified of Walmart in Grocery.

Inflation is still elevated but moderated. Cautious outlooks for second-half smart in discretionary.

Walmart and off-price will continue share gains in second-half.

Results speak for themselves.

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on Shopify, you might also like: