What You Need to Know About Shopify’s Deliverr Acquisition

Although Shopify and Amazon aren’t direct competitors today, their moves certainly suggest otherwise. And whether you are an investor or business owner in the eCommerce industry, it is critical that you pay attention to how this ongoing battle is playing out. This article attempts to demystify a few key questions:

How Did We Get Here?

How Has Shopify’s Business Model Evolved?

What Is Shopify Hoping For In Its Acquisition of Deliverr?

What Does That Mean For Me?

Is The Deliverr Acquisition Going to Work?

Setting Up The Backstory: How Did We Get Here?

It seems like it came out of nowhere, but actually, Shopify has been tinkering with fulfillment for some time.

Early in 2022, Bloomberg leaked a major story that Shopify was considering a major $2B acquisition of a logistics company named Deliverr. This news sent shockwaves across the eCommerce ecosystem as it set the stage for Shopify to simplify the lives of all merchants by creating a “one-stop shop” to acquire a wide array of logistics services.

In a major turn of events, the very next day Amazon made a major announcement that it had launched its Buy With Prime program, allowing buyers to check out and receive a one-day or two-day Prime promise, as long as their inventory was housed in Amazon’s warehouses.

A few weeks later, Shopify’s acquisition of Deliverr was announced by Shopify and interestingly CEO Tobi Lutke fumbled a question from an analyst during quarterly earnings related to the Buy with Prime program.

Source: Deliverr

What this has set up is a clash of ideas and strategies between Shopify and Amazon: Shopify’s merchant-first approach versus Amazon’s traffic-first approach.

Shopify cares first about the creation and building of new brands but leaves it to the brand owner to find traffic for their store and products. Amazon, on the other hand, advocates for brands to “fish where the fish are” given that 74% of product searches start on Amazon, and 56% of those consumers then use Amazon as the location for their purchases. Of course, you are kind of renting the fish in this analogy.

Shopify has superior tools for building your brand, at the cost of building your own audience, and Amazon has superior tools for getting access to traffic, often at the expense of much of the uniqueness of your brand and ownership of that customer.

This suggests that there is a very stark and significant difference in contrasting worldviews that are at play here.

How Has Shopify’s Business Model Evolved?

For years, Shopify was just another monthly-subscription based eCommerce platform. A popular one, for sure, but the business model was pretty vanilla. They had one easy-to-understand SaaS business model.

Similar to any monthly subscription software, if a merchant signs up and stays, then Shopify collects a monthly fee. Shopify has never given any information on their merchant retention numbers on a unit percentage basis (Shopify only reports revenue cohorts), but I expect this number could be as high as 50% due to the large numbers of small merchants involved. Don’t quote me on that, however! :-)

Sure, they tiered it with Shopify Plus, but what changed the game was the introduction of Shop Pay in 2017.

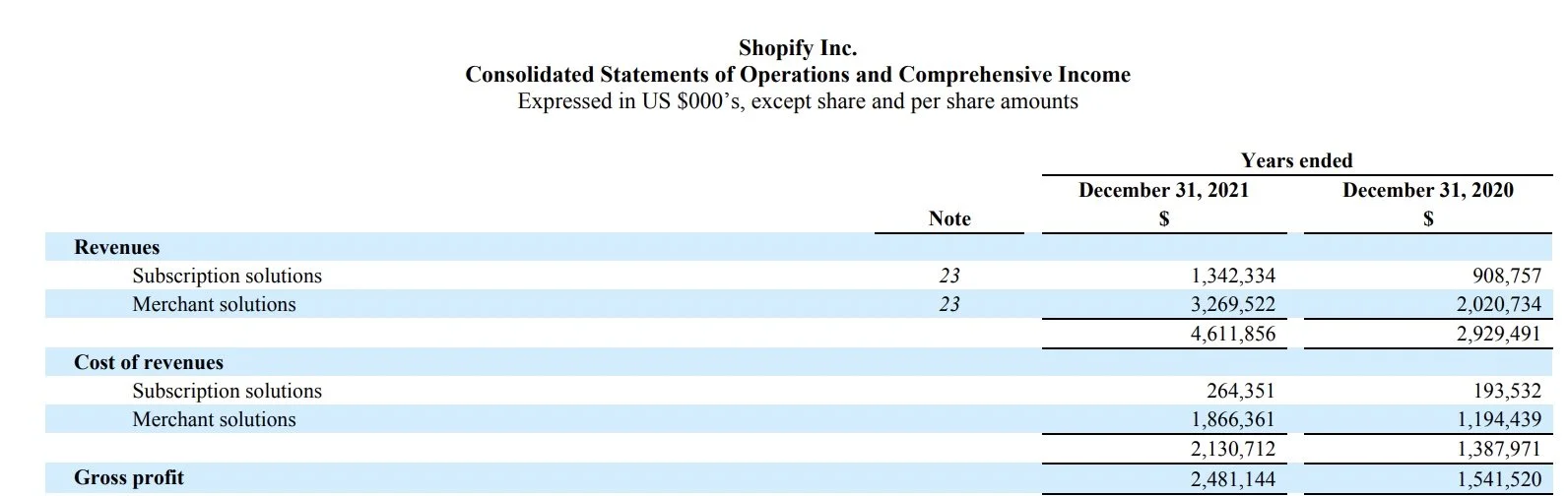

Shop Pay added another entire business model to Shopify - one based on GMV and payments. They call this Merchant Solutions, which includes things like Capital and Developer App fees. That said, payments is by far the largest driver. This added an entirely new layer to the business model, which as you can see from their 2021 Annual Report, has completely eclipsed its traditional business.

Source: Shopify 2021 Annual Report

Shop Pay has been a big accelerant for Shopify’s growth and the cumulative GMV for Shop Pay and accelerated checkout crossed $50 billion in Q1 2022.

What’s more, the growth of the Merchant Solutions business overall is now double that of its Subscriptions revenue. This is important because it means that Shopify has become a GMV-focused company much more than a monthly subscription company.

Over time, this is likely to tend to shift the focus from “all merchants” to “growth merchants” despite its entrepreneurial roots. (Which ironically makes Shopify Plus more important in the long-term, despite the company’s lack of relative focus on it — but that is for another article)

With the announcement of its acquisition of Deliverr, Shopify has added another new revenue stream to its business model: Parcels.

While Shopify Fulfillment Network was launched in 2019, with the pandemic intervening, it never gained much traction amongst Shopify merchants. The acquisition of Deliverr gives them a true asset-light logistics network.

As interesting as it is to follow Deliverr, this is not Shopify’s first acquisition in the fulfillment space. Their previous acquisition of 6 River Systems gave them robotics assets plus they have been building a proprietary Warehouse Management system. Shopify has built its own facility in Georgia aimed at small merchants who sell less than 1000 items per month.

Shopify has now created a new entity called Shopify Logistics which contains 6 River Systems, Shopify Fulfillment Network, and now Deliverr. It's worth noting that this business is now being led by Aaron Brown who (surprisingly) never has led a logistics enterprise, despite being a former Amazoner.

Shopify has decided to add Deliverr to its Shopify Fulfillment Network capabilities to offer brands simplified logistics management, with demand-driven inventory placement to ensure reliable two-day or one-day shipping can occur. This essentially is the anti-Amazon aiming to help brands use an independent and flexible solution.

The Battle for the Consumer: What Is Shopify Hoping For With Its Deliverr Acquisition?

While Shopify has been tinkering with logistics for a few years now, most observers were still shocked at the scale of Shopify’s bet on Deliverr: $2.1B.

Some observers looked at the fact that there are so many small Shopify merchants and concluded that Shopify running a logistics business could never work — after all, a supply chain requires high volume to achieve consistent profitability.

Other observers still wondered why Shopify would place such a big bet on a field that eCommerce platforms traditionally left to their partner ecosystem.

The only logical explanation for Shopify's fulfillment experiment is about marketplaces as a consumer slingshot, and the clue is in two areas. In short, Shopify wants a more direct relationship with the consumer, and it views Deliverr as the fuel to get it there.

First, if you go back to the history of Deliverr, what really put them on the map was their 2-day shipping deal with Walmart. Deliverr quite simply is the reliable delivery promise for Walmart's marketplace.

Second, the mention of Shop Promise in the press release. What’s that?

Source: Shopify

Shop Promise is a new badge that displays two-day and next-day delivery promises on merchants’ online stores and other channels. Think about that - it’s another lever that Shopify can use to measure the performance of brands that is going to be viewable on Google, Meta, Instagram, and on the Shop app.

If you believe this statement, then you must next consider its underlying premises. What must be true if this is Shopify's aim?

One, Shopify must feel that Walmart and other marketplaces will not be able to run a truly independent third-party fulfillment service on its own. And every scaled marketplace needs a fulfillment service, and for any non-scaled one, it's certainly useful. As a result, I expect Shopify could be successful in setting up more marketplace partnerships with different retailers of all sizes.

This program would replicate what Deliverr already proved in the past, but extremely widely.

Two, Shopify is betting that marketplaces need Shopify more than Shopify needs them. Let’s be honest for a moment here — every marketplace needs Shopify merchants to populate its unique inventory. It is simply the largest source of brands outside of just calling on Amazon sellers. So Shopify will be in the room already.

This gives them leverage and an opening for Shop Promise.

Shop Promise is the same Trojan Horse that Amazon is trying to establish in another realm with Buy With Prime (skeptical of their success at the moment, but for another article).

Once Shop Promise is in the door, Shopify will have a clearer path to a direct consumer relationship. Even then, it doesn't have to build a marketplace, but it would certainly make it easier should it choose.

Successful marketplaces need both Shopify merchants and reliable fulfillment. This will get Shopify in the door -- and that will be attached to Shop Promise. Once Shop Promise is in the door, Shopify will have an opening to a much deeper buyer relationship. I don't expect Shopify knows what the next step is after that, but once it gets to this point, it will have a better field of view on its next steps. After all, Tobi Lutke views life as an infinite game. It must be that Shopify’s previous experiments justified further exploration on the company's part, despite having almost no results to show for it to date.

Fulfillment as Battleground: What Does This Mean For Me?

The battle between Shopify and Amazon creates an interesting situation as Amazon has Amazon Pay which is part of Buy with Prime on a third-party website now (beta, as of this writing). Amazon’s solution is dependent on the third-party seller using Fulfillment By Amazon.

Of course, Shopify requires merchants to use Shop Pay as part of the Shop Promise solution. It also seems like it will require merchants to use Shopify Fulfillment Network.

As a direct-to-consumer merchant, this could make your life more complicated in the future if Shop Promise starts taking off. In the past, fulfillment was often in the background. Where you decided to place your inventory was nobody’s business but your own. Fulfillment by Amazon was something for Amazon merchants to worry about and more of an accelerant for that channel to boost your Buy Box win rate or guarantee Prime placement.

While both of these services are designed to provide superior service to the consumer, it also makes your life as a merchant more complex. You must now decide how much to allocate to different fulfillment partners, too. And not just from a fulfillment performance point of view, as has been the case in the past. These inventory placement decisions could impact your sales projections as well. Good problem, I guess, but is the average brand ready to make that kind of decision before landing the inventory?

Who Needs a WMS Anyway? Shopify’s Other Bet

One sidebar here. One of the things that Shopify is betting on here is that it can make the Warehouse Management System (WMS) and eCommerce integration a commodity. Especially if you are operating your facility, you need to acquire a WMS to locate, pick, pack, and ship your parcels efficiently.

Furthermore, if you are using a 4PL like Shopify Logistics, you are literally absorbing margin on top of margin from the various providers that are in the mix. After all, Shopify has been very clear that it’s trying to make money from the software itself, leaving Deliverr’s various 3PL partners to fend for themselves. Furthermore, who’s to say that Shopify won’t try and double-dip by charging these same 3PLs to be part of its network — after all, who is providing the software?), further reducing their partner’s margins.

By providing the WMS itself, Shopify is hoping to eliminate an entire category of software, thereby potentially reducing the total cost of software ownership for its merchants, despite some of that being added back in margins on its own. Existing WMS providers, beware. Shopify is coming for you.

Wrapping Up: Is The Deliverr Acquisition Going to Work?

Source: Deliverr Twitter

“Who knows” is the best answer! Shopify has little experience with operating subsidiaries; and Deliverr, despite having a large upside, could create complexity for Shopify, SFN, and customers. With Deliver, Shopify can now offer sellers a service they are currently outsourcing to 3PLs. So if Shopify does this right, there is the potential to generate additional revenues from brands at scale.

Another question I wonder about is — If Deliverr is so important, and Shopify has limited experience in the supply chain, why would Deliverr’s CEO not be automatically considered for CEO of Shopify Logistics? Supply chain experience and management is currently a skill that Shopify does not have in abundance. The current CEO of Shopify Logistics does not promote confidence in the long-term viability of Deliverr and its place inside the organization.

Finally, there is still the question of scale. Shopify has one key advantage here in that Deliverr is a software solution. President Harley Finkelstein likes to say over and over that Deliverr is “asset-light,” which limits their exposure to the capital requirements of building new facilities that Amazon has. It also doesn’t need to concern itself with the profitability of those facilities.

However, that line of thinking only goes so far. Shopify (formerly, Deliverr) is in a deep partnership with its 3PL network. If its 3PL partners are not profitable, that directly affects Shopify, too. After all, how long would you accept business from a key business in which your own profitability interests were not aligned with that partner?

All of these concerns and more are things we will all be able to watch play out over the past few years. If you’re anything like me, you suspect that Shopify is starting from ground zero in fulfillment. After all, how many of us can even name a Shopify Fulfillment Network customer pre-Deliverr? Hardly anyone.

Therein lies both Shopify’s opportunity and greatest risk.

Hi, I’m Rick! My company, RMW Commerce Consulting helps private-equity backed brands in the mid-market (roughly $50M to $1B) optimize their eCommerce results, in addition to helping eCommerce service providers with their positioning, vision and messaging. Because I’ve worked with both brands and service providers, I’m uniquely positioned to help both sides grow revenue, improve profitability, and make smarter decisions about their strategic plans.

If this sounds like something you could use help with, contact me here, like dozens of other companies have already done.