Klaviyo IPO Sets the Bar for Profitable SaaS Going Forward

What Is Klaviyo’s S1?

This article attempts to learn from Klaviyo's S1 filing.

An S1 is an SEC registration document required to be filed by companies that want to be listed on a national exchange in the United States.

Klaviyo hopes to raise at least $750M in capital for its initial public offering. The company most recently raised $320M in its last funding round in 2021, which gave it a pre-money valuation of $9.15 billion.

What is Klaviyo's Mission?

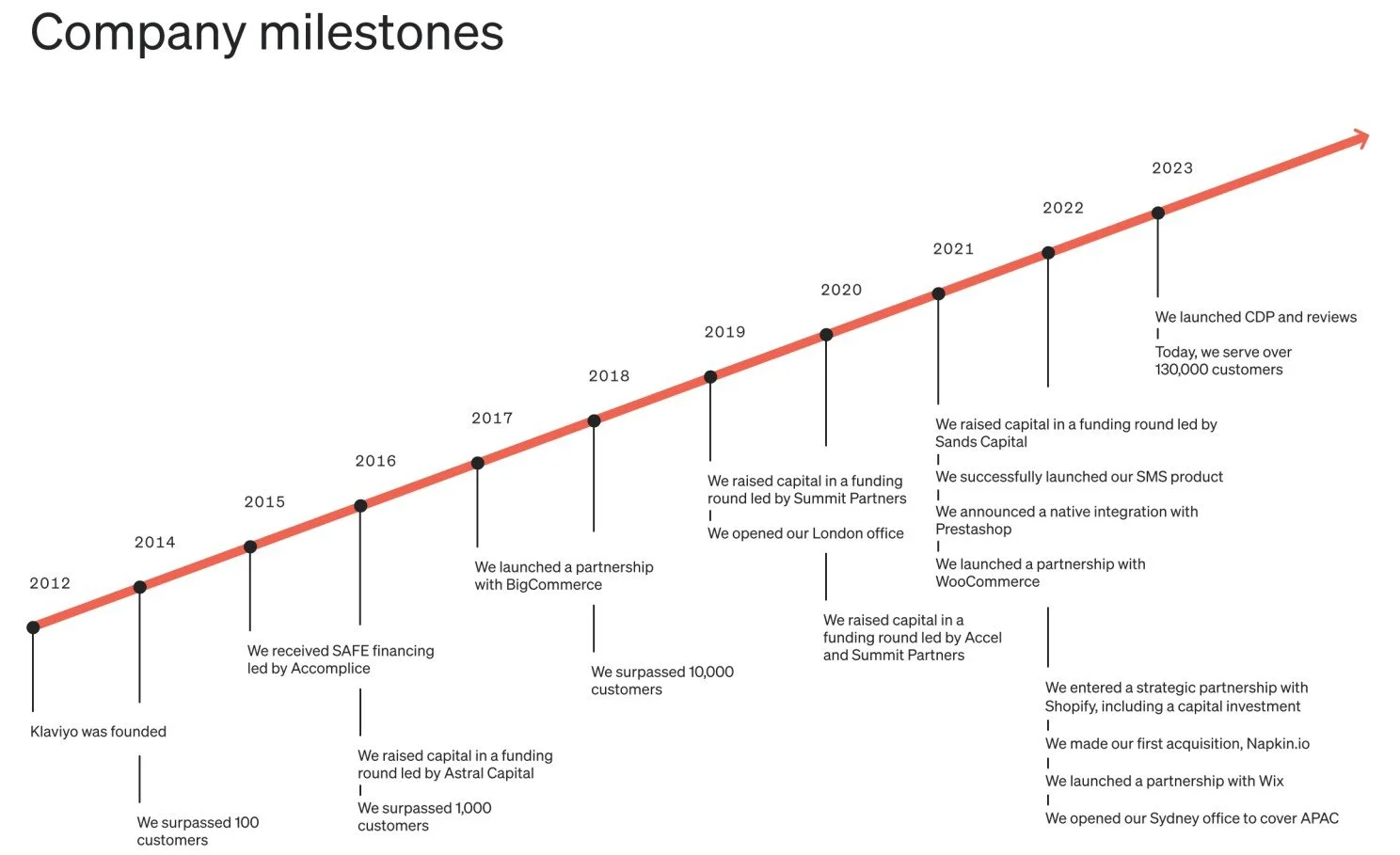

Klaviyo was founded in 2012 and is based in Boston, MA. Klaviyo’s mission is neatly encapsulated in several phrases I pulled out of the S1:

Businesses today struggle to deliver impactful consumer experiences because they cannot effectively harness increasingly complex consumer data.

Other software solutions were not purpose-built to harness customers’ first-party data to deliver impactful consumer experiences.

By vertically integrating our data layer and marketing application, we make it easy for businesses to create and store unified consumer profiles and then use them to derive new insights and drive revenue generation.

A powerful mission. The key here isn't just that Klaviyo can deliver customer experiences - that's a commodity. It's not just that Klaviyo can integrate customer data; that is also a very competitive space. Klaviyo competes at the intersection of these two areas. In particular, a vertically integrated solution often works well in the SMB and mid-market segments, or for an Enterprise customer where each component part isn't considered a core competency.

A vertically integrated stack does mean that it will be unlikely for Klaviyo to be able to compete up-market in the Enterprise segment, but given that Klaviyo is only just beginning to penetrate the mid-market segment, this is not too large of a risk.

Source: Klaviyo S1, Platform Description

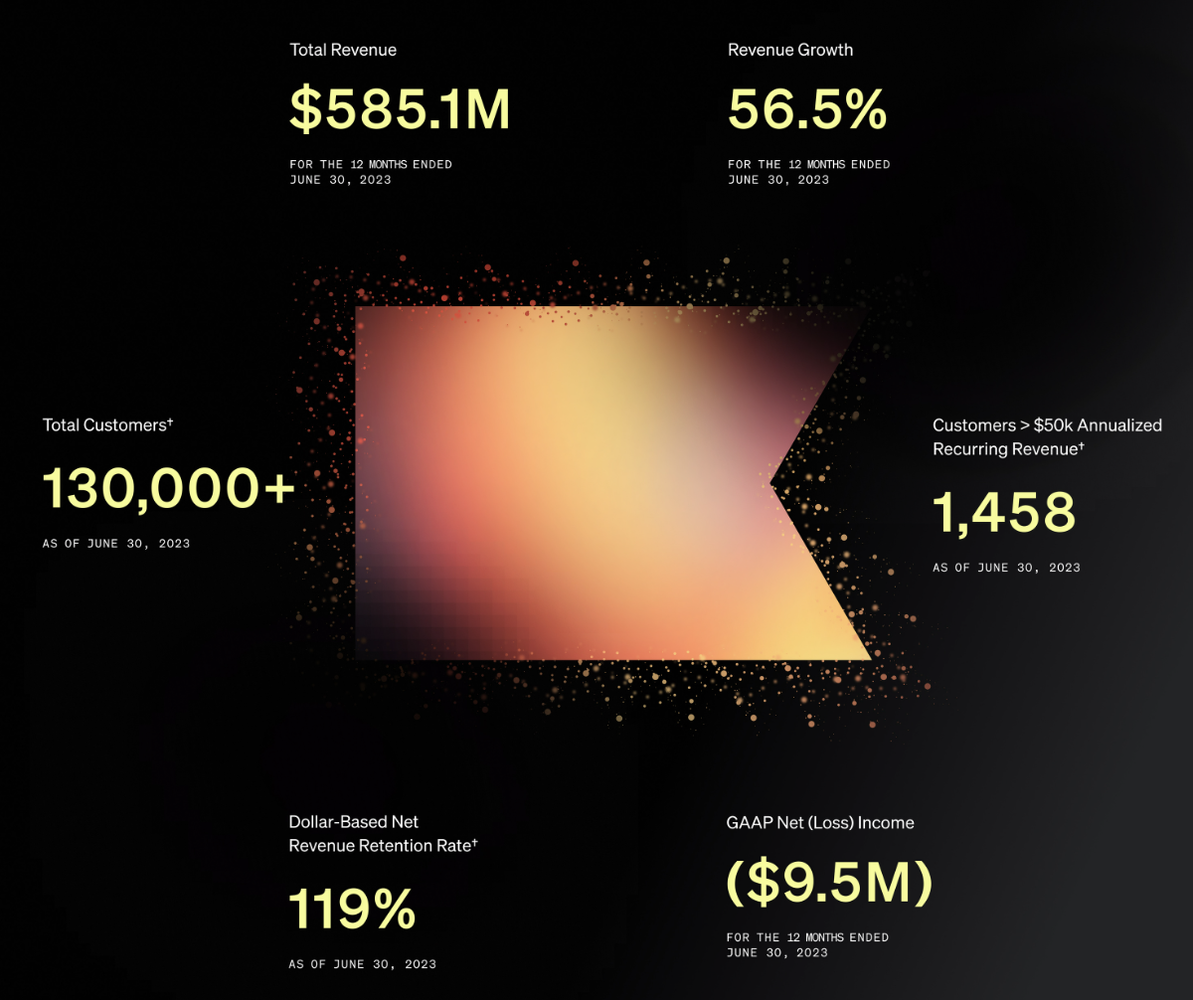

What are Klaviyo's Key Metrics?

Here are some information based on the six months ending June 30, 2022:

1,548 employees

130k+ customers (up from 105,000 customers in June 2022) = 23.8% y/y

$585M Annual Recurring Revenue (ARR)

$4,500 Annual Revenue Per Account (ARPA)

$7.9M operating income in 1H 2023

Over 110% Net Recurring Revenue Retention

The company has raised $454 million, but it has only spent approximately $10M of it.

14-month CAC payback period

Source: Klaviyo S1, Key Metrics

What Has Klaviyo’s Growth Been?

I pulled out a few key Klaviyo metrics from the past few years. The right-most column only represents a half-year.

Source: Klaviyo S1

2022 Notes affecting these numbers:

Klaviyo estimates that the 2022 price increase raised revenue mid-single digit percentages in 2022 compared to 2021.

2023 Notes affecting these numbers:

The price increase in September 2022 represented a mid-teens percentage increase of incremental revenue dollars in the first six months of 2023.

Cohort ARR increased 12% y/y

Sales to existing customers = 58% of revenue, net new customers = 42% (mostly mid-market and international).

March 2023: 10% Layoffs

How Efficient and Profitable is Klaviyo?

Over the past few years, Klaviyo has been getting more efficient when judged by its operating expenses as a % of its overall revenue. Its 2023 numbers of 21% R&D as a % of revenue mean it is not “over-innovating” to keep customers. This number, despite increasing, has remained steady on an overall basis.

Klaviyo's 38.6% Sales and marketing as a % of revenue did not happen overnight. As you can see, in 2021, this number was 53.8% of revenue, which is a serious problem. Going forward, the big risk to Klaviyo is that a lot of its revenue growth (58%) comes from existing customers and 42% from new customers. I expect the ratio to continue to favor existing customers more each year.

As a result, Klaviyo’s growth does appear to be decelerating, especially when you back out the effects of price increases:

2022:

Revenue growth: 64%

Minus effects of price increases: ~5%

2022 Net y/y revenue growth: 59%

Now let’s look at this compared to 1H 2023:

Revenue growth: 54%

Minus effects of price increases: ~15%

2023 Net y/y revenue growth: 39%

Klaviyo’s new customer acquisition rates seem to be decelerating, and as a result, Klaviyo, in the future, will need to rely much more on its existing customer’s adoption of new products, similar to the way that companies like Salesforce report their growth. After all, the company cannot afford to raise prices every year.

There is one thing to note about Klaviyo. Klaviyo is not an eCommerce platform. As a marketing engine, it can afford to invest less in R&D than companies like Shopify as long as its product set remains static. You can expect that if Klaviyo starts to acquire new companies and continues to aggressively expand its Reviews, CDP, and SMS offerings, it will have to keep increasing that R&D spend. The company does seem fairly committed to keeping that R&D number below 21% of revenue, however, based on the data they have provided.

What Does Klaviyo’s Go-to-market Engine Look Like?

Source: Klaviyo S1, Sales and Marketing Engine

Klaviyo breaks down its market segments into three buckets:

SMB = $100k - $20M

Mid-Market = $20M - $400M

Enterprise = $400M+

(These are very solid definitions [I'm looking at you BigCommerce!], although for omnichannel companies, you can see Enterprise start between $800M - $1B)

Klaviyo primarily has a product-led growth motion that targets the Chief Marketing Officer, Chief Customer Officer, and other functional marketing leaders.

To measure the effectiveness of its sales and marketing efforts, it measures net new Annual Recurring Revenue (ARR), which is evenly distributed through these channels:

Inbound channels (product-led growth)

Outbound channels (sales-led growth)

Agency partnerships

Klaviyo estimates that these sales channels contribute equally to Klaviyo’s growth. This is a good rule of thumb for any SaaS company, and I have even seen partner-acquired sales reaching 50% of ARR for other SaaS companies.

Klaviyo reports that 10% of its new ARR was through the App Store. Assuming that Klaviyo’s inbound channels generate 33% of net new ARR in a period, that means Klaviyo gets about one-third of its inbound sales through App Store installs. A reminder not to over-focus on the App Store as a source of revenue.

Klaviyo reports a CAC Payback period of 14 months. Overall, Klaviyo has a very well-established customer acquisition engine.

What is Klaviyo’s Relationship with Shopify?

Source: Klaviyo

Shopify’s relationship with Klaviyo is quite complex. Let’s start with some basics.

Shopify owns 11.2% of Klaviyo, approximately 26 million shares.

Klaviyo’s platform concentration is 77.5% Shopify.

In July 2022, Klaviyo signed an agreement with Shopify.

Here are the terms of Shopify’s current agreement with Klaviyo:

Shopify must maintain Klaviyo as a Shopify Plus partner.

Shopify must promote Klaviyo as its “Recommended” E-mail Provider for Shopify Plus merchants.

On July 28, 2022, Klaviyo sold 2,951,846 shares of common stock to Shopify for approximately $100.0 million.

Shopify can purchase additional shares at a specified price until 2030.

The agreement terminates in 2029, and Shopify cannot terminate for convenience.

Here are the terms of Klaviyo’s current agreement with Shopify:

For Shopify Plus, Klaviyo must pay Shopify a monthly integration fee for each Shopify Plus merchant.

For lower Shopify tiers, Klaviyo must pay Shopify a fixed percentage of revenue not greater than what Shopify charges other Shopify partners.

How much does Klaviyo pay Shopify for its merchants?

2020: $5.2M paid to Shopify

2021: $7.8M paid to Shopify (5% of sales and marketing spend of $156M)

2022 $16.2M paid to Shopify (7.6% of sales and marketing spend of $213M)

Shopify Relationship Assessment

Here are a few of my thoughts.

One of the top reasons for Klaviyo’s negotiation with Shopify is uncoupling its payments to Shopify for its Shopify Plus merchants to revenue and instead making it a fixed monthly integration fee.

I expect that Klaviyo’s status as a Recommended Email provider for Shopify Plus is quite lucrative, particularly if you understand Klaviyo’s land and expand strategy. You can compare these fees to the fees that Google pays to Apple for being the default search engine on Safari.

I expect similar language in other provider agreements where Shopify made a strategic investment, i.e., Yotpo.

What are Klaviyo’s Biggest Opportunities Going Forward?

The company has a lot of room to run within its existing Retail and e-commerce vertical. Klaviyo’s estimated serviceable addressable market opportunity within this vertical is over $16 billion (585M captured) = 3% of the market.

Klaviyo believes its platform applies to other verticals: education, events and entertainment, restaurants, travel, and B2B. In the US Klaviyo estimates its TAM in these verticals at $34 billion in the United States. This is all theoretical, however.

This gives Klaviyo a lot of room to run. However, not all elements are addressable. Both Hubspot and Salesforce are well-positioned in both the B2B space. From my point of view, Klaviyo’s easiest addressable growth opportunities include:

Penetration of new product offerings like SMS, Reviews, and CDP into existing customers. (SMS Usage, for instance, is used by 14.8% of customers as of June 2023, up from 8.5% at the end of 2021 — steady progress)

SMB segments Internationally. (As of June 2023, 30% of revenue is from non-US accounts).

Mid-market segments in the United States and later Internationally.

New verticals that act similarly to eCommerce and Retail are not well-served by competition.

Enterprise segments in Retail and eCommerce.

What are Klaviyo’s Biggest Risks?

In many ways, the flip side of Klaviyo’s risks is its opportunities.

Overall, the company has a low customer concentration risk. Klaviyo’s top 10 customers represent only 1.4% of ARR as of June 30, 2023.

The company is heavily weighted to Shopify, which represents a huge risk. Penetration in non-Shopify eCommerce platforms. (Shopify represents ~77% of platform concentration)

Klaviyo may not be able to penetrate verticals outside of retail, which represent less than 5% of its current revenue.

Klaviyo S1, Company Milestones

What Are My Top Takeaways from Klaviyo’s S1 Filing?

Wrapping up, I wanted to note a few key takeaways from the document.

Klaviyo has only spent $15 million to get to $585m in ARR and an IPO filing. This is despite raising $454 million. Most of it has gone unused, which reflects a core Klaviyo value to remain capital-efficient.

Greater than 100% Net Revenue Retention helps you grow faster. If you have a leaky bucket problem, you have a tough future as a SaaS business.

Be willing to pay bounties to partners like agencies and platforms, especially if you can be named a preferred provider of a valuable service.

Shopify has quite a complex relationship with Klaviyo, and many of these agreements for the service providers are about reducing their marketing costs to acquire customers as a % of their revenue. That, in addition to the capital infusion!

If you are considering going public as a software provider, serious preparation is needed 2-3 years before getting the company in the right shape to be attractive to outside investors. This is very different than acquiring customers at any cost.

Finally, I don't care who you are, it's difficult to build a $500M+ ARR SaaS business with metrics like these. Ultimate respect to these founders Andrew Bialecki and Ed Hallen.

Further Research

The information for this article has come from several sources, primarily the Klaviyo S1: